Church

Accounting Software

Keep your faith-based organization afloat with the proper management of finances. Save time, simplify accounting and streamline growth.

Happy Users

Invoices Sent

Available Languages

Streamline Church Accounting

Work with Church accounting software that eases fund management and the burden of accurate day-to-day bookkeeping of donations.

Cash Flow

See the details of cash flow in and out of your organization. Clearly understand how much money you receive and spend on operations and outreach programs.

Bills

Stay on top of your accounts payable and never miss payments with the billing calendar. Save time by auto-capturing paper receipts with quick document scans.

Double-Entry

Customize your chart of accounts to fit the church's structure. Maintain a general ledger account, keep the church's books balanced and easily track donations.

Donations

Receive donations in multiple currencies with payment options that support your organization's reach and growth: online payments, bank transfers, or crypto.

Bank Reconciliation

Connect multiple bank accounts, auto-sync transactions, and view them all in one place. Reconcile bank transactions with your accounting data with a few clicks.

Reporting

Get a clear view of your church's financial position with customized reporting. Obtain insights from financial data that support informed decision-making for growth.

Focus on things that matter.

Do more for the community while spending less time managing your finances. Akaunting's Accounting software for churches provide features that enable you to...

Forcast and control spending

Do budgeting

Plan and measure the monies needed to manage your day-to-day, monthly and yearly expenses. Estimate your income/expenses and foresee any potential financial shortfalls.

Do more with less time

Automate processes

Seamlessly handle accounting tasks with automation—auto-schedule financial reports and run bookkeeping processes like recurring invoices and bills without breaking a sweat.

Expand your capacity

Manage Projects

Manage multiple church projects and account for projects under construction. Track time, add team members, share dashboards, and see transactions/activities on each project.

Extend donation options

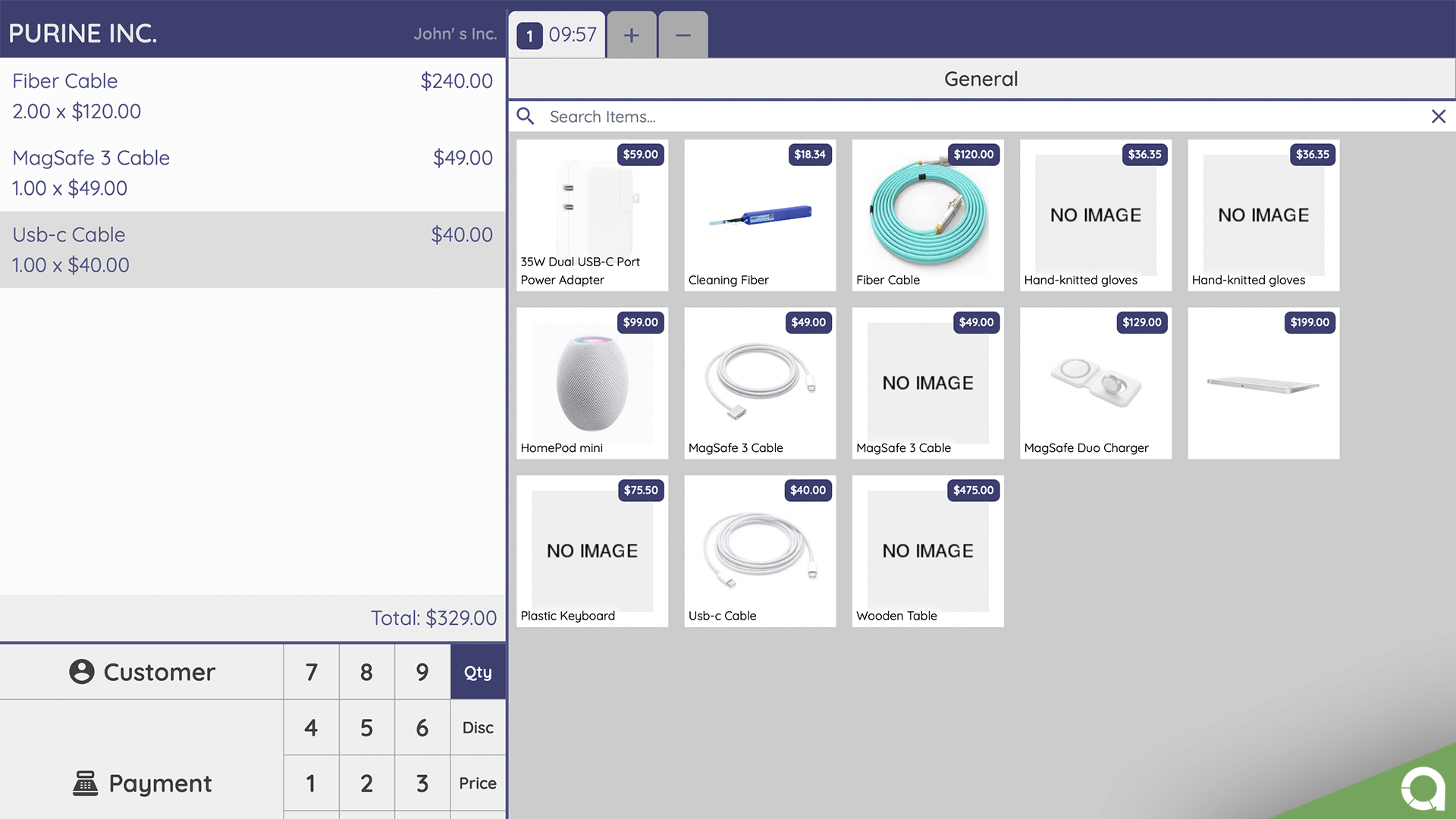

Integrate POS

Turn your church accounting software into a practical Point of Sale. Offer payment options to donors, automate donations, and generate reports/charts and electronic receipts.

Work with a team

Add Team Members/Volunteers

Scale your team as the organization grows to reach more communities. Add team members, define permissions, and assign roles. Collaborate on outreaches to touch more lives.

Appreciate your team

Run Payroll

Simplify payroll management and reduce time spent on payment processes. Get on-demand team member information, and customize payment methods, benefits, and deductions.

Discover the graceful way of doing church accounting

Manage budgets, Receive donations, Pay bills, and Automate bookkeeping processes with ease.

Global SMBs trust Akaunting

Translated in 50+ languages, the ease of accounting makes Akaunting the favorite of small businesses worldwide.

-

100+ Countries

-

300K+ Users

-

10M+ Invoices Sent

-

Safe and Secure

-

24/7 Customer Service

-

Cancel at anytime

Frequently Asked Questions

Here are some of the most common frequently asked questions

Does Akaunting have a church program?

Akaunting helps you track and manage your nonprofit organization's expenses and budgets. You can track your donations and run financial reports to see how the organization performs financially.

Which Software is best for accounting?

The best Software for accounting is one that is customizable to fit your business needs and has the essential features to save you time and support business growth. Accounting software should have the following features:

- Invoicing

- Expense management

- User-friendliness

- Security

- CRM capabilities

- Easy Customization

- Bookkeeping capabilities

- Financial reporting and projections

Is Akaunting free?

It is free with unlimited invoices, bills, customers, and multicurrency support. Manage your small business at zero cost. Sign-up, set up your company, and send your first invoice at no charge.

Do churches use GAAP?

Churches are required to follow the generally accepted accounting principles (GAAP) for various documents and reports and comply with the requirements set in place by the IRS.

Do churches get audited by the IRS?

The IRS may begin a church tax inquiry only if an appropriate high-level Treasury official reasonably believes, based on a written statement of the facts and circumstances, that the organization: (a) may not qualify for the exemption; or (b) may not be paying tax on unrelated business or other taxable activity. This reasonable belief must be based on facts and circumstances recorded in writing.

How do you do bookkeeping for a church?

Bookkeeping for churches is much like every other business that receives money, pays employees, manages projects/inventory, pays bills, and owns a bank account. Have a daily, weekly, and monthly checklist of all financial transactions that affect your organization's financial health and accountability. These are Accounts Payable/Receivable, Payroll, Checks, Journal entries, etc.

What method of accounting do churches use?

Many churches use a cash basis—recording income and expenses when they are received and paid—or a combination of both accrual and cash approaches. Your choice of method depends on your church's structure.

Do nonprofits have to use GAAP?

Nonprofits need to follow the Generally Accepted Accounting Principles (GAAP).